USA

USA Outlook Update (July 28, 2007, New grap added on Nov. 7, 2010): A Recession Watch! Massive downward revisions in the 2nd Quarter (2007) GDP report paints

a much weaker US economy than we have perceived.

USA Outlook Update (May 2, 2007; Note added on March 5, 2010): Current status of US economy and its prospects.

USA Outlook Update (Nov. 19, 2006): Inflation update

USA Outlook Update (Oct. 31, 2006): September consumer spending is strong! Media reports are wrong.

USA Outlook Update (Sept. 7, 2006): Personal Consumption Expenditure and GDP from 2005 to 2006; a recession is not in sight.

USA Outlook Update (July 28, 2006): GDP of second quarter of 2006, and the prospect of inflation and interest rate

USA Outlook Update (May 26, 2006): Revised real GDP of 1st Quarter of 2006 and its adjustments

USA Outlook Update (May 19, 2006): GDP of 3rd Quarter of 2005 to 1st Quarter of 2006 and beyond

USA Outlook Update(January 28, 2006):GDP of 4-th Quarter of 2005

USA Outlook Update:(January 21, 2006)

Outlook Update(August

18, 2005)

Outlook Update:(April 14, 2005)

With the stock market behaving as if a recession is coming, some readers probably

want to know our assesment of the economic outlook in The United States of America.

As has been said in the last outlook update, American economy is entering into

another bridge phenomenon as discussed in Article No.2. However, there is some

difference between this bridge phenomenon and the last such event in the late 1990's.

The last bridge phenomenon witnessed rapid expansion of trade deficits

accompanied by steady GDP growth rates. This bridge phenomenon consists of rapid

expansion of trade deficits and the slightly decreasing GDP growth rates. We have

been estimating that the GDP growth rate will drop toward 3% annual rate in 2005,

and then toward like 2.5%. It probably will hit a bottom near 2.5% and continue at that level

well into 2007 and 2008. A recession is certainly not in the card in near future.

The stock market was dancing with overly rosy forecasts that GDP growth rate will continue

to be 4% plus as far as the eye can see. When the reality sets in, the market is

panicking and now it thinks as if a recession is imminent. The truth lies between

the over confidence of the market in the past and its loss of confidence at

the present. We have been talking about an eventual collapse of Dollar and a world

wide depression. But this kind of catastrophe from the growing imbalance in the

grobalization sheme is many years away; it can be a decade or more away even if

the global financial policy makers continue their misdirected policies as they are

still pursuing today.

Outlook Update:(Feb. 12, 2005)

The graph accompanied Jan. 17 update contains two calculation errors. The November

adjusted trade deficit was erred on the upside and the September data was erred on

the down side. Those errors are corrected in the graph, and a new data point

of December adjusted trade deficit is plotted as a blue dot. After this revision

it becomes clearer that the modest fall of Dollar vs. Yen and Euro during

the spring of 2002 has only slowed the expansion of US trade deficit a little

bid. The subsequent mild Dollar rebound of the fall of

2002 is now producing a sharp escalation of US trade deficit in the final

quarter of 2004. Though the direct trade deficit with Japan has been stagnating

since the fall of 2004 and the direct deficit with Europe is also showing the

sign of peaking due to the weakness of Dollar vs. Yen and Euro in 2002, all

those positive indications are swamped by the rapid expansion of the direct

trade deficit with China, the worst senario feared in an earlier discussion in

this column. Since Japan and Taiwan are using China as their surrogate exporter

this rapid expansion of the direct trade deficit with China is reflected in

the suspended large overall trade surpluses of Japan and Taiwan. The major

reason of this still expanding direct trade deficit with China is, of course,

the persistant under-valuation of Chinese Yuan vs. US Dollar.

The Chinese economic expansion is due to the massive Dollar buying of

Chinese Government in order to peg Yuan to Dollar at a fixed rate. As Dollar

is bought, corresponding amount of Yuan is released into the domestic Chinese

market. Those Yuan will eventually end up in the hands of national

banks of China. Chinese local governments have exclusive priority to borrow

from the local branches of national banks, and have used those borrowings

to escalate fixed invesments rapidly, often withought careful calculation of

future economic viabilities. This local government led expansion, often in

the form of joint ventures with outside investors, is the real engine behind

the economic growth of China. Those local governments will be the strongest

voice against the revaluation of Yuan, since a free floating Yuan means the

cease of Dollar buying and less credits through the local branches of national

banks in addition to the higher valuation of Yuan vs. Dollar that will topple

their new joint ventures that are mostly to manufacture and export to USA.

It is unlikely that the central government of China can summount such a

formidable local oppositions and will alow Yuan to float voluntarily in any

forseeable future. We believe that the soft persuation of US Government will

fail to push Yuan to revaluate in 2005. This means that US trade deficit will

continue to expand in 2005, or in the most favorable case stagnate at a very

high level. The rate of expansion of US trade deficit in 2005 will probably

fall between 9 to 12% comapred to 2004 average. This kind of expansion will

also mean that the ratio of trade deficit to nominal GDP will increase further

in 2005, and thus another "bridge" phenomena is probably in the making.

The unanticipated event that may upset this outlook is a direct confrontation

about the valuation of Yuan in the form of import tax imposed on Chinese made

goods, as discussed in the comment titled "looming confrontation about the value

of Chinese Yuan". If such an import tax is imposed, the effect on trade balance

will be immediate, not like two or more years of delay in the case of varying

exchange rates. As mentioned in the comment, China is replaceable in the

globalization scheme. Thus the manufacturing base will move away from China

if a significant import tax is imposed on Chinese made goods. However, such

trnasitions take time, and we will see disruptions before the dust settles

in the event of such an import tax. At first import prices will rise and

US trade deficit will shrink or stagnate according to the amount of import

tax imposed. Then as the manufacturing base shifts away from China into other

developing countries US trade deficit will turn upward again. During and after

this transition period Chinese economic expansion will be halted. The global

commodity prices will fall and that will compensate the rise of import prices

of manufactured goods to make the overall inflation rate in USA unchanged,

but the economic performance of USA will suffer due to the temporary

dip of the trade deficit.

Out Look Update (Jan.17, 2005)

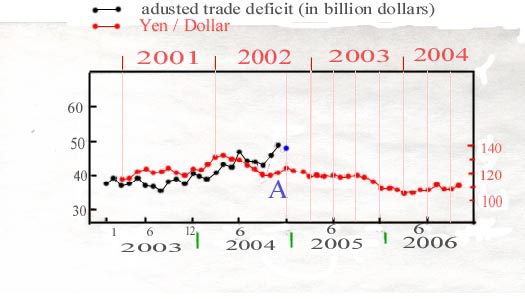

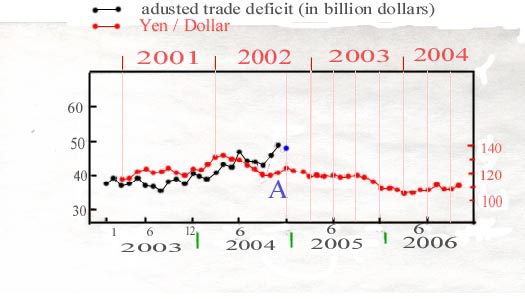

The November, 2005 trade balance report raises some important points and desreve

a close attention. The October trade deficit number is revised up sharply and

the Novermber trade deficit number seems to support this sharp upward revision.

In the figure the monthly merchandise trade deficit excluding the import of

oil and the export of agricultural commodities are plotted as black dots. The

red dots are monthly averages of Yen/Dollar with the time scale shifted toward

the right by two years and three months; for example, the red dot appeared at March, 2003

is actually the value of Yen/Dollar at January, 2001. The reason of this time

shift is explained in Article No.2; the currency movement tends to foreshadow the

trade balance at least by two years.

The November, 2005 trade balance report raises some important points and desreve

a close attention. The October trade deficit number is revised up sharply and

the Novermber trade deficit number seems to support this sharp upward revision.

In the figure the monthly merchandise trade deficit excluding the import of

oil and the export of agricultural commodities are plotted as black dots. The

red dots are monthly averages of Yen/Dollar with the time scale shifted toward

the right by two years and three months; for example, the red dot appeared at March, 2003

is actually the value of Yen/Dollar at January, 2001. The reason of this time

shift is explained in Article No.2; the currency movement tends to foreshadow the

trade balance at least by two years.

The figure implies that the modest drop of the value of Dollar versus Yen that

occured in the spring of 2002 was

not effective in curbing the US trade deficit in recent times. With the

subsequent slight bounce of Dollar as shown by the red dots around October of 2004

in the figure, US trade deficit exploded anew. This is the picture that the

competitive power of US industry is steadily eroding due to the long running

trade deficit, not due to the slow growth of US trading partners as some

soothsayers try to claim. Looking ahead from the figure, no good news with

regard to the trade deficit should be expected through the most part of 2005.

In the second quarter of 2004 the merchandise trade deficit is about 5.5% of

GDP. In 2005 this number will certain to top 6%. As pointed out in

Articles No.2 and No.7, for a society to grow economically based on running

large trade deficits, that is equivalent to borrow a huge sums from foreigners

for domestic consumption, new and high paying categories of jobs must open

up to compensate the loss of jobs due to the corrupting effect of the trade

deficit. The late 1990's was such a period when computer based high tech

industry flowered and ushered in the era of internet. However, it is not the

situation at present, and the current rapid expansion of trade deficit is

not going to lift GDP growth rate very much. For the most part of 2005, GDP

growth rate will probably stay at 3.0 to 3.5% level with the possibility of

further deterioration at the end of 2005. Another gentle drop of the value of

Dollar as the red dots in the figure shows near the end of 2005 is an importat

land mark to watch. If that modest drop of Dollar (occured in the middle of

2003 and prompted Japanese Government to launch that 300+ billion dollar

worth of dollar-buying frenzy) does not curb US trade deficit in any

meaningful way, then we are sure that US economy has entered another so

called bridge phenomena as discussed in Article No.2. This bridge phenomena

will be accompanied by subdued economic growth rate but equally explosive

expansion of the trade deficit compared to the last bridge phenomena that

occured in the late 1990's. As US trade deficit expands steadily, the selling

pressure for Dollar will built up in the currency market. Very soon Japanese

Government will need to intervene again, this time probably with one trillion

dollar or more dollar buying operations. If Japanese Government can not

muster the political power to perform such an astronomical dollar-buying

operation, then Dollar will collapse, followed by a sharp curtailment of

US trade deficit with two years lagging time, and US economy will experience

another burst of bubble that will certainly be much more painful than the last

burst of bubble that happened from late 2000 to 2001.

Out Look Update (Jan.07, 2005)

This leg of falling Dollar that started at the spring of 2002 has finally shown

effects on US trade balance. US trade deficit was rising rapidly toward June, 2004

and than entered a period of peaking process. The export excluding agriculture

commodities is growing, though at a measured rate. The imports excluding petroleum

related products has peaked in June, and has stagnated since then. Thus the

adjusted trade ballance excluding oil and agricutural commodity has peaked in June

and now is at the level of March, 2004. Even the overall merchandise trade balance

that is boosted by the high oil price is showing the sign of stagnation. Since the

fall of Dollar continued until the end of 2003, the stagnation of US trade

deficit probably will continue for a while. We expect US econoomic growth rate

will continue its slow descend throughout 2005 with some unpleasant surprise

possible in the latter half of 2005. Some recovery of the economic growth rate

during the first half of 2006 is in store, but then the declining growth rate

trend will resume during the second half of 2006, reflecting the very recent fall

of Dollar. Only thing that can derail this slow decline of the growth rate

trend is a sudden massive currency market manipulation by Japan, in the order

of 500+ billion Dollars to boost the value of Dollar substantially. If that

happens, US consumption along with the trade deficit will burst upward in 2007.

On the other hand if Japan does not defend the 100 Yen/Dollar level, a sharp

and sudden fall of Dollar is in store, and US economy will slide into a

recession in 2007 to 2008 along with a declining trade deficit.

Some analysts argue that the budget deficit of the federal government is contributing to

the trade deficit. However, this argument is clearly wrong; we only need to

remind ourselves that during the Clinton era, budget deficit was under control

but the trade deficit exploded. When the federal government runs deficit, it

borrows first from the pool of foreign money provided in the form of trade

deficit. When the government budget is balanced, it will be the private sector

that borrows the entire amount from that pool of foreign money. Though both

types of borrowing will eventually recycle those foreign money back into the

whole economy, the first type of government-borrow-first arrangement makes

the speed of circulation of money slower compared to the second type

private-borrow-first arrangement because governments are always more inefficient

in spending the money it posses than the private sector. Thus if government

budget is balanced, the consumption component in GDP will be larger than the

case of budget deficit. However, larger personal consumption means more

import and thus larger trade deficit; it is totally in contradiction to the

arguments of many financial analysts but explains well why the balanced

budget and the exploding trade deficit came in unison during the Clinton era.

Discussion: Trade Deficit and GDP (Oct. 22, 2004)

The core trade deficit (exclude oil related imports and agriculture

related exports) has peaked in July at 46.7 billion dollars, and are 38.5

billion and 39.9 billion dollars in July and August respectively. Probably

the two-year-leading-currency effect as discussed in Article No.2 of this

website is taking effect due to the meaningful fall of Dollar in the spring

of 2002. However, the fall of Dollar in 2002, though is not small, is not

very large either, so we only expect a moderate reduction in US economic

activity. A more significant slow down of US economy will only come in

the latter half of 2005, reflecting another leg of meaningful fall of Dollar

versus Yen and Euro in the latter half of 2003.

Country-by-country trade data published monthly are non-seasonally adjusted.

The seasonally adjusted data are only available quarterly. Thus the seasonally

adjusted data only cover up to June of 2004. To use non-seasonally adjusted

data to gauge the recent performance of country-by-country trade pattern

is rather difficult. Year-to-year comparison using non-seasonally adjusted

data only tells us that something have happened during the past 12 months,

not necessarilly what is happening in the most recent reporting month.

Looking at the monthly chart of non-seasonally adjusted countrywise trade

deficit data, it seems that US direct trade deficit with China is still

growing strongly; US direct trade deficit with Europe may be starting to

peak, but the evidence is not convincing; US direct trade deficits with

Japan and NIC's (newly industrialized countries, mainly smaller Asian countries)

are staggernating. It should be noted that Japan's overall trade surplus

is growing rapidly in recent months due to strong exports to China and

NIC's. This means that the direct trade deficit with Japan may be small,

but the indirect trade deficit with Japan (Japan using China and NIC's

as its surrogate exporters) is still very large.

To blame the recent deacceleration of US economic growth on the rising

oil price is without the base, since the rising oil price can only hurt

the the economy if it is pushing inflation higher, but is not according

to the published inflation gauges. We can only blame the subpar economic

performance on oil price if we believe that the published inflation gauges,

especially the price deflator used in GDP report, are not reflecting the

real inflation rate by overemphasizing the improvement of quality of goods

that US consumers buy.

Discussion: Second Quarter GDP and Beyond (Sept. 15,

2004)

At the time when we made the first forecast of US economic performance

in this space on Nov. 7, 2003 and called for the growth rate of real GDP

to slow in the second half of 2004, most economic analysts were widely

optismistic about the final six months of 2004. Now the consensus of economic

analysts calls for slowed growth rate during the second half of 2003; even

their consensus projection of the growth rate of the second half of 2004

becomes not very far from our projection of annualized rate of +3.5%.

However, we project that the growth rate of real GDP will continue to come

down in the first half of 2005, with a marked slow down in the second half

of 2005 and an upturn in the growth rate will only occure in 2006 at the

earliest, wheareas most economic analysts are still widely enthusiastic

about 2005 and beyond.

The important economic statistics of recent months is the slow GDP growth

rate of the secon quarter; the recently revised number is up 2.8% and that

number should be compared to +4.5%, +4.2% and +7.4% of the first quarter

of 2004, the 4-th quarter of 2003 and the 3rd quarter of 2003 respectively.

The slow growth of GDP in the second quarter is mainly the result of the

dismal performance of inflation adjusted personal consumption that only

grew +1.6% in the quarter. It is important to understand why this sudden

pull back by US consumers since the underlying reasons will help us to

gauge the economic performance of the second half of 2004. Many analysts

immediately point their finger toward the high oil prices during the second

quarter as the culprit, arguing that high oil prices reduce the buying

power of consumers on one hand and hurts consumer sentiments at the same

time. However, the validity of this argument is questionable. Personal

spending is measuring both the purchase of non-oil related products and

oil-related products by consumers. Merely shifting consumer spending more

to oil-related products due to higher prices of those goods should not

itself cause the overall personal consumption to suffer. Also through

the second quarter, various consumer sentiment surveys have recorded strong

consumer optimism, in total contradiction with the argument. Then

what is the real reason of this sudden swoon? We first look at the real

(inflation adjusted) disposable personal income. The growth rate of the

2nd quarter of 2003 was +4.2%, the 3rd quarter of 2003 was +7.9%, the 4th

quarter of 2003 was +1.4%, the 1st quarter of 2004 was +2.4% and the 2nd

quarter of 2004 was +2.4%. The growth rates of the real (inflation adjusted)

personal consumption were +3.9% for the 2nd quarter of 2003, +5.0% for

the 3rd quarter of 2003, +3.9% for the 4th quarter of 2003, +4.1% for the

1st quarter of 2004, and +1.6% for the 2nd quarter of 2004 respectively.

The real disposable personal income does not synchronize with the real

personal consumption from quarter to quarter, but in longer run, weak income

growth will result in weak personal consumption, and the relatively weak

growth of real personal disposable income since the fourth quarter of 2003

has finally caught up and has caused the drop of the growth rate of the

real personal consumption in the 2nd quarter of 2004. Another important

factor is the home mortgage rates. In recent years US personal consumption

has been supported by falling home mortgage rates, escalating housing prices

and the aggressive mortgage refinancing that put sizable readily spendable

cash in the hands consumers; those consumers take out new mortgages the

amount of which far exceeds the amount of their repaid old mortgages, but

their interest rate payments are steady due to the falling mortgage rates.

However, the mortgage rates rose suddenly in the 2nd quarter of 2004, causing

the reduction of mortgage refinancing and thus curtailed the spending power

of US consumers.

The next step is to understand why the rise of the mortgage rates and

the stagnating growth of the real disposable personal income. The inflation

rate as measured by the core CPI has peaked in March and has been sliding

down through the second quarter. Thus inflation can not be the reason for

the rise of the mortgage rates in the second quarter. One possible reason

is the ending of Japanese Government's buying of Dollar; bond traders feared

that the absence of Japanese Government means less buying of US treasuries

and thus higher long term interest rates. The endless rise of the oil prices

through the second quarter has also planted the fear of the phantom of

inflation in the hearts of bond traders at a time when the actual inflation

rate is falling. Then there has been the fear of Federal Reserve's policy

to put the short term interest rate back to the normal stance; this move

actually should help to reduce the inflation danger and thus reduce the

long term interest rates, but at that time bond traders' fear has been

outrunning the logics. When those fears have been proven just to be phantoms,

long term interest rates along with the mortgage rates have fallen anew

since July. The stagnation of the growth of the real disposable personal

income is not related to inflation either since the nominal (no inflation

adjustment) disposable personal income has shown very similar growth pattern

as the real disposable personal income. In this economic recovery, businesses

are loath to hire more permanent emplyees due to the lack of clear view

about the future of the economy. Thus the increase of workers, the normal

phenomena of a recovery cycle, only means many more temporary workers and

low pays. This phenomena immediately translates into the stagnation of

personal income. Foreign competiotions as manifest in the run away trade

deficit is probably the underlying trend of less commitment to long term

hiring by businesses and thus is the root cause of the stagnation of the

personal income.

Let us now assess the possible outcome for the second half of 2004.

The stagnation of personal income growth is not likely to be reversed.

However, mortgage interest rates are already falling anew since July, so

the consumer spending should get a moderate boost. We expect that the economic

performance in the second half will be better than the second quarter,

with GDP growing close to 3.5% (annualized).

Some words about the trade balance that is the favorable topic of this

web site. The fall of Dollar in the spring of 2002 against Yen and Euro

should be translating into the slow down of the growth of US trade deficit

around the middle of 2004. After taking away oil related imports (higher

oil price and balooning energy related trade deficit is a negative to the

economy, unlike the deficit due to manufactured goods that will boost

consumption), the adjusted imports are showing signs of a slowed growth

to stagnation since the spring. However, the adjusted exports (subtracting

away agricultural products and a small amount of energy related exports)

is showing a more marked stagnation at the same time. Usually weaker Dollar

should be boosting adjusted exports but is not. The result is that the

adjusted trade balance is not yet shrinking. The quick stagnation of exports

is an interesting event and is also a warning to US economy. This phenomenon

means that the exports from US, mostly are industrial supplies, machinaries

and transportation related goods, are not driven by market forces but by

political influences. Many countries sustain large trade surpluses with

USA, and receive constant threat of retaliation from US domestic industries

under heavy pressure of foreign competitions. Thus those countries have

a tendency to deliberately increase imports from USA even deemed not favorable

from pure market considerations to molify US anger toward their large trade

surpluses. When their exports to US (means imports of US) show any signs

of softness, they will gladly cut back those political imports from US,

and thus the quicker stagnation of US exports than US imports. This means

that the real competiveness of US exporters is weaker than the trade figure

shows. On country by country basis, direct imports from Japan, Taiwan are

slowing, but imports from China is growing strongly. Also imports from

South Korea has jumped strongly in recent months and imports from Euro

region still shows no sign of abatement. The expanding imports from Canada,

Mexico and the remaining Latin America are related to higher energy and

other commodity prices. Overall we expect that the merchandise trade deficit

of USA will grow more slowly in the second half of 2004 when the full impact

of a weaker Dollar since the spring of 2002 sinks in, exerting a downward

pressure on the growth rate of real GDP.

Discussion: GDP, Aug. 2, 2004

July 30 GDP report says that the real GDP of the second quarter of 2004

has grown by 3.0 % in annualized rate, and the growth rate of the first

qurter is revised upward to 4.5 % from the original estimate of 3.9 %.

The surprisingly weak 3.0 % growth rate of the second quarter is causing

a mini panic among economic analysts; many has started to paint a much

more bleak picture for the second half of 2004. We should realize that

the new statistics is pushing the robustness of the first two months of

the second quarter back into the first quarter and thus causing the lackluster

preformance of the second quarter on one hand and much more properous first

quarter than initially thought. Without the push back effect, the second

quater GDP will be growing at 3.6% against 3.9 % growth of the first quarter.

Quarterly GDP growth rate gyrates widely and subjects to significant revision

even many years later. For example, this new release of GDP statistics

on July 30 has revised GDP growth rates back to the first quarter of 2001,

and causing the original two consecutive quaters of negative growths, the

second and the third quarters of 2001, to disappear; this revision wipes

out the most recent official recession since according to the definition

a recession is consisting of two consecutive quarters of negative growths

in GDP. Does this mean that the recent economic down period as anyone concerned

about the economic condition of the country has noticed is just a mirage?

Of course not. As we are emphasizing that it is futile to hang on to the

detailed number of GDP growth rate in each report whereas the accuracy

of such estimate is probably only good to like plus-minus 1.0% when is

originally reported. What we should look at is the gross trend of GDP growth

rates. No matter we use the original estimate or the new estimate, GDP

growth rate has peaked in the middle of 2000, has headed down and then

stabilized. It has only started to recover in a sustained way since the

second quarter of 2003. What we are syaing here is that this recovery will

be short and the trend of the growth rate will weaken again around the

middle of 2004 and will continue to go down until the end of 2005. Only

in 2006 we may see another upward turn of the trend of GDP growth rate.

The down turn of the trend will probably bottomed out around 2% annualized

growth rate, or a little lower. We are definitely entering a relatively

slow growth period, restrained by the run away trade deficit and by the

fact that Dollar can only retain its value by frequent massive currency

market manipulations of Pacific rim countries.

The trend of an economic movement is powerful. Seemingly shocking noneconomic

events, in short term looks like causing huge dislocation in economy, are

often really irrelevant to the long term trend of the predestined economic

movement. Take the 911 tragedy as an example. US economy has been going

down before 911. The growth rate of real (means inflation adjusted) personal

consumption in GDP account is as follows: +1.7% in the first quarter

of 2001, +1.0% in the second quarter of 2001,

+1.7% in the third quarter of 2001, +7.0% in the fourth quarter of

2001, and +1.8% in the first quarter of 2002. It is hard pressed to find

any effect of 911 from the statistics. How about the business investments?

It is -13.6% in the first quarter of 2001, -7.6% in the second quarter

of 2001, -10.5% in the third quarter of 2001, -22.7% in the fourth quarter

of 2001, and +16.8% in the first quarter of 2002. In order to associate

the business investment numbers to 911, we need to stretch our imagination

to argue that businessmen were very calm right after the tragedy, started

to panic a few month later when consumers were already resuming their spending

spree, and then abruptly reversed their panic into a euphoria just one

quarter later. Many analysts and money managers attribute the current financial

and stock market stagnation to the fear of noneconomic events like terrorism

and the coming presidential election. We believe that the stagnation reflects

the sencing of the market of the coming trend change in the long term movement

of the economy, no matter who is elected president in November or irrespective

of other noneconomic events.

General Discussion: July 19, 2004

Since the long term projection made on Nov. 7, 2003, more than 6 months

have passed. It is a good time to review that long term projection and

to extend the projection further into the future. Readers are reminded

again that our projection about the course of the economy is based on the

belief that in the globalization era, the factors shaping up the globalization,

that is, the relative values among major currencies and the trade balances

have significant influence on the global economy as a whole and causes

booms and busts in various economic entities, not necessary in a synchronized

way; the old fashion factors to shape the outcome of an economic entity

like monetary and fisical policies are often overshadowed by the new globalization

factors.

In the first phase of Nov. 7, 2003 projection, we said that the 4-th

quarter of 2003 and the 1st quarter of 2004 would not be as sizzling as

the 3rd quarter of 2003, but would be respectable. The real GDP growth

rates of those two quarters were respectable 4.1% and 3.9% respectively.

The first two months of the 2nd quarter of 2004 were robust in terms of

the consumer spending, but the consumer spending cooled down substantially

in June. As a whole we expect the growth rate of real GDP for the quarter

will remain around 4%. The second half of 2004 will see the slow down of

the growth with real GDP around 3.5% and slightly below. This gradual slow

down will continue into the first half of 2005, and there will be a more

meaningful drop in the growth in the second hald of 2005, probably to 2%

or below. There probably will be a rebound in the first half of 2006. Through

this rather stoggy cycle we do not expect the growth rate of real GDP will

dip into the negative territory so that we are not talking about a recession.

What will cause US economy to have another robust boom like the one

in the latter half of 1990's? It requires Japanese Government to buy up

a few trillion dollars in the currency market and keep US Dollar above

130 Yen/Dollar level for a prolonged period; we do not foresee this possibility.

If in the equaly unlikely event Japanese Government walks away from the

currency market manipulation outright, then Dollar will collapse and a

sever recession will set in sometime in 2007. The most likely senario is

for Japanese Government to buy up several hundred billion dollars from

time to time to keep Dollar to fall below 100 Yen/Dollar level, though

the amount of dollar needed to be bought will increase steadily. In this

most likely senario, US economy will continue to grow slowly whereas the

trade deficit will remain around 5% of GDP. The external debt of USA will

increase steadily since every year's trade deficit will be added to the

external debt; eventually the whole globalization scheme will collapse

under the weight of unbalanced trades.

Projection: June 26, 2004: Inflation

Since the beginning of 2004, CPI core index (consumer price index less

energy and food) has turned into a trend of steeper rise than previous

years; in 2003 CPI core rose 1.1%, and in 2002 it rose 2.0%. CPI core is

much more resilient and less volatile than the overall CPI index that is

called CPI all. From past experiences, when CPI core index has a major

trend change, the trend has lasted at least for one year, and often much

longer. Assuming this new trend will also last at least for one year, a

simple extrapolation shows that CPI core will rise about 3% plus in 2004.

This kind of inflation rate will require a Fed. Fund's rate substantially

higher than the current level.

Projection: Feb. 25, 2004: About Jobs (a technical

analysis)

Jobs, or lack of them become not only as a big economic concern, but

also is shaking up as an important political focal point in this election

year. Here, we will present a technical analysis of the job situation.

A technical analysis is a study based on the past empirical experience

and tries to gauge how the current situation will evolve. Before going

into the analysis, we need to discuss which employment data the analysis

will use. As is well known, there are two well publicized data samples

about the job situation; the nonfarm payroll employment survey and the

household survey. The nonfarm payroll employment survey covers established

businesses and tally their employees, full time and part time, but will

miss selfemployed and fluid situation of small businesses; the area of

lack of coverage needs to be projected. The household survey supposedly

will cover the selfemployed. However, the coverage of selfemployed causes

a problem, especially at a time of economic hardship and many laidoff high

tech workers. It is very easy to establish a small business on line today.

Many unemployed high tech workers probably are doing exactly that. Unfortunately

most of them only brings in a meager income, and they really should be

classified as unemployed. But in a household survey many of them will answer

as selfemployed, thus causing a distortion in the survey. Also the size

of the statistical sample of the household survey is a concern. Each month

the household survey covers about 60,000 household entities only. Assuming

each entity consists in average 2 workers, the survey will only cover 120,000

workers. It requires a huge extrapolation to be projected to the whole

population. A small change in population composition thus can cause a large

fluctuation in the result of the household survey. This is why there are

suspicious gaps in the household survey data when the population compositions

are readjusted. The nonfarm payroll data consists of monthly survey of

300,000 businesses. Assuming that each surveyed business average out with

100 employees, then the survey will cover like 30,000,000 workers. With

such a large sample, the projection to the whole population is less prone

to error. That is why traditionally in economic circle the nonfarm payroll

data is cosidered to be more accurate. We also adhere to this notion and

use the nonfarm payroll employment data exclusively for this analysis.

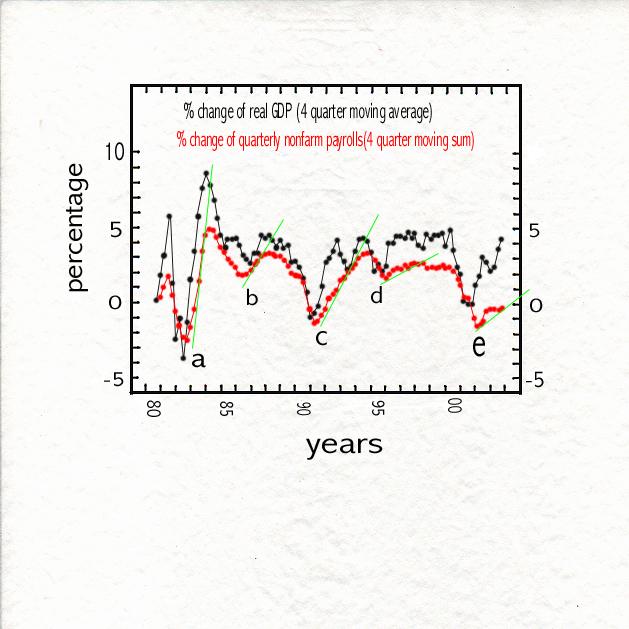

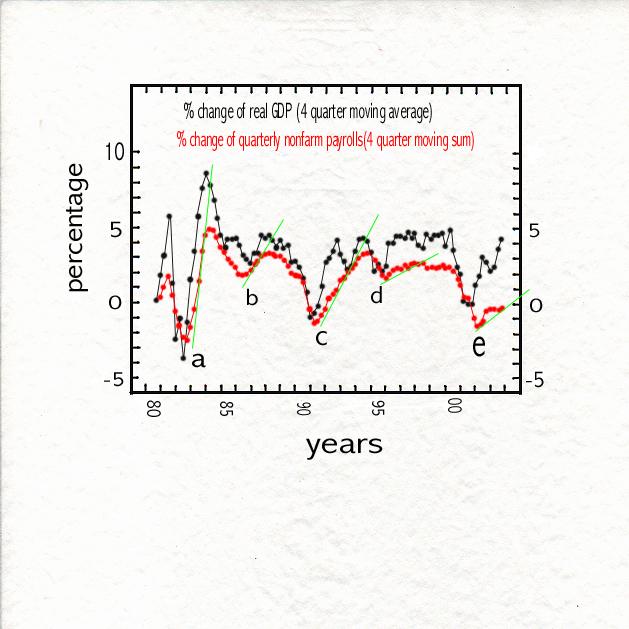

We start by comparing the economic growth, that is, the percentage change

of real GDP with the percentage change of nonfarm payroll employment data

from quarter to quarter. To smooth out the violent oscillations in the

quarterly real GDP growth data, 4 quarter moving average of real GDP growth

are computed and plotted as black circle in the following figure. To match

that real GDP data, quarterly averages of nonfarm employment data are taken,

percentage changes from quarter to quarter are calculated, and 4 quarter

moving sums of the percentage changes are plotted as red circles in the

figure.

The discrepency between the black curve (GDP) and the red one (employment)

measures the productivity gain; larger the gap between two curves, higher

the productivity gain is. The red curve is much more smoother than the

black one. The recovery from the employment bottom are marked from "a"

to "e" for the red curve. The rise of the red curve from the bottom is

more prominent near the bottom. In each rise we can draw a contact line,

the green ones, to the red curve, and the red curve moves up along the

green line and then cross the green line toward the right in a sidewise

movement. The rightmost green line around mark "e" is for the present time.

We can confidently say that during 2004 the red line will not deviate considerably

from the green line. Since the green line passes the point 0.5% at the

end of 2004, we can say that the nonfarm payroll employment probably will

grow like 0.5 % from the median of the fourth quarter of 2003 to the median

of the fourth quarter of 2004. In a very optimistic estimate we assume

that the red curve will move away and above the green line somewhat but

most likely will not exceeds 1.0% by the end of 2004, judging from the

past performance as shown in the figure. Thus we obtain the growth in nonfarm

payroll employment from the 4th quarter of 2003 to the 4th quater of 2004

in the range from 0.5% to 1.0%. Translated into the number of jobs created,

it will range from 0.65 to 1.30 million jobs, but the real number probably

will be closer to the bottom of the estimated range. It should be noted

that in contrast to the smooth red curve, the black curve is quite bumpy.

Thus even the economic growth in 2004 is significantly uncertain, say falls

somewhere between 3 to 5%, the projected job growth will still hold. In

other words the divergence between the reasonable economic growth

and the lackluster job creation will continue in 2004.

Many attribute the productivity gains squrely to technology advances.

During the latter half of 1990 when US corporations invested heavily in

information technology, this explanation may sound reasonable. However,

during the recent recovery marked by "e", corporations are not expanding

their investments in information technology, but the productivity gains

have become even more impressive than the late 1990's as the ever bigger

gap between the black curve and the red one indicates. The one cause of

productivity gain that many desperately try to forget is "outsourcing".

Since outsourcing is done from the lower paid jobs first, it will definitely

improve the productivity of a company. Alternatively we may say that if

outsourcing does not improve productivity, then there will be no reason

for US corporations to do outsourcing at all. This explanotion of outsourcing

based productivity gain fits well with the data from 1995 on. We should

notice that during the latter half of 1995, supposedly the era of many

new jobs created by computer and information technology, the rate of job

creation is quite slow compared to the preceeding eras as the figure shows;

this phenomena can be explained easily if we attribute the improvement

of the productivity of the latter half of 1990 more to outsourcing than

to information technology advances. Then after 2001, the outsourcing intensfied,

and even more anemic rate of job creation and larger productivity gains

persisted. It should be reminded that the slopes of the green lines are

steadily flattening out as the globalization proceeds; it indicates that

the outsourcing is steadily intensifying as globarization advances and

is causing increasingly anemic job growth in USA, even at a time when real

GDP grows substantially.

Some may ask how an economy can grow and personal consumption can expand

whithout substantial creation of jobs. The answer is that it is due to

the magic of trade deficit (Refs. 1

and 2 ). Trade deficit is nothing

more than to borrow from foreigners and spend. This borrowing from foreigners

is translated into domestic borrowings and windfalls that have little to

do with the creation of jobs. Let us go through two major routs to show

how the trade deficit is translated into domestic "borrow and spend" booms.

As foreign made goods flood the domestic market, pricing power is taken

away from the domestic market. As the consumption level rises (Americans

must digest all those imported goods), not inflation but disinflation becomes

the norm. Thus The Federal Reserve System can keep interest rate low for

a very long period beyond the imagination of modern economists. The prolonged

low mortgage rates create a huge housing bubble, and home owners use refinancing

and home equity loans to get hands on a large amount of money. This route

of borrowing through the housing market definitely boosts consumption,

in the form of buying imported goods, but results in only anemic job creation.

Furthermore, as trade deficit baloons, large sums of dollars are handed

over to foreigners. Foreigners must deposit this huge amount of dollars

back to USA, mostly in the form of buying US Treasuries. Some one in USA,

either US investors and/or US Government, must sell those US Treasuries

to foreigners. Those American investors who receive dollars for their sale

of US Treasuries will reinvest the dollars in the stock market, creating

a bubble in the stock market which bestow a windfall on stock holders and

Wall Street professionals. On the other hand when US Government gets the

proceeds of saling Treasuries to foreigners, it can engage in a deficit

spending binge. This rout through US Treasuries again will push up personal

consumption, but disconnected from any effect of creating meaningful jobs

in USA. Anyone who is interested to know how a jobless society can prosper

simply from running huge trade deficits is invited to read Article No.7

posted in "The Section for Everyone" of this website, or click

here to go directly to the article.

Projection(long term): Nov. 7, 2003

Ministry of Finance of Japan has manipulated the currency market after

Japanese Yen has hit a temporary peak at the beginning of 2000 in order

to destroy the value of Yen ( equivalent to boost the value of US Dollar)

and to increase merchandise trade surplus of Japan. With two years of delay

US merchandise trade deficit has started to increase anew from the middle

of 2002. However, the talk and the occurence of Iraq war, and then the

SARS epidemic have delayed the translation of this renewed surge of US

merchandise trade deficit into stronger US consumer spending. In the summer

of 2003, this pent-up consumer spending comes in at once as the first phase

of Iraq war is over and SARS has retreated into the background. That is

why in the 3rd quarter of 2003, US GDP has had a phenomenal growth. Though

will not repeat such super hot performance, the growth rate of US GDP in

the 4th quarter of 2003 and the 1st quarter of 2004 will still be substantial

thanks to the expanding merchandise trade deficit. However, the strong

Dollar as manipulated by Japan from 2000 has suffered a reversal in the

spring of 2002, and US trade deficit with Japan and other smaller Asian

countries is going to be curbed starting from the spring or the summer

of 2004. Furthermore, strong Euro is going to suppress imports of luxuary

goods from Europe starting from the spring or summer of 2004. Unless imports

from China can replace high qulity Japanese imports and luxuary goods from

Europe (very unlikely), US merchandise trade deficit is going to decrease

starting from the summer of 2004. With that turn arround of US merchandise

trade deficit, US economic growth also will become slower. This slowdown

of economic growth will intensify in the fall of 2005 and will continue,

at least until the end of 2005.

The rate of inflation in the coming economic slowdown is uncertain.

Consumer spending must come down with the decrease of the merchandise trade

deficit. If the will of consumer to spend declines slower than the decrease

of the merchandise trade deficit, the price level in general will rise

and will limit the ability of the Federal Reserve System to lower interest

rates to combat the economic slowdown. If consumer sentiment cools faster

than the fall of the trade deficit, then the disinflation will continue

and FED can still lower the short term interest rates. However, with the

short term interest rates already at very low level, how much more FED

can act without falling into the trap that Japan is in is a question.

The employement situation will only improve modestly during the current

phase of economic expansion, since unlike the boom of Clinton era there

is no prospective of the opening up of any new industry to absorb a large

number of labors. The manufacturing sector employment will continue to

be pressured in an economic expansion based on trade deficit. The service

sector is experiencing increased number of jobs since more people are needed

to bring the increased imported goods to consumers, and more hands are

required to recycle the Dollars accumulated in the accounts of foreigners

(due to the increased trade deficit) into US financial markets. As the

economic slowdown sets in, the situation will be reversed, that is, less

pressure on the manufacturing sector and doom in the retail and financial

service sectors. However, the fall of Dollar in the spring of 2002 and

in the fall of 2003 are too small to really turn around the US manufacturing

sector employment.

Return to the projections main page

Return to Subscriber's Corner Home Page

Return to the Home Page of the Website

The November, 2005 trade balance report raises some important points and desreve

a close attention. The October trade deficit number is revised up sharply and

the Novermber trade deficit number seems to support this sharp upward revision.

In the figure the monthly merchandise trade deficit excluding the import of

oil and the export of agricultural commodities are plotted as black dots. The

red dots are monthly averages of Yen/Dollar with the time scale shifted toward

the right by two years and three months; for example, the red dot appeared at March, 2003

is actually the value of Yen/Dollar at January, 2001. The reason of this time

shift is explained in Article No.2; the currency movement tends to foreshadow the

trade balance at least by two years.

The November, 2005 trade balance report raises some important points and desreve

a close attention. The October trade deficit number is revised up sharply and

the Novermber trade deficit number seems to support this sharp upward revision.

In the figure the monthly merchandise trade deficit excluding the import of

oil and the export of agricultural commodities are plotted as black dots. The

red dots are monthly averages of Yen/Dollar with the time scale shifted toward

the right by two years and three months; for example, the red dot appeared at March, 2003

is actually the value of Yen/Dollar at January, 2001. The reason of this time

shift is explained in Article No.2; the currency movement tends to foreshadow the

trade balance at least by two years.