Behind the Gyrations of Euro/Dollar Exchange Rate

by

Chih Kwan Chen

(January 15, 2004)

Abstract

The merchandise trade balance between USA and Western Europe is shown to

be determined by

the exchange rate between US Dollar and Euro and its predecessor currency.

The ups and downs

of the exchange rate is then analysed and traced back to various economic,

financial and political

reasones. This analysis allows us to project the future course of the exchange

rate.

1. Introduction

In the eighties and nineties,

the major part of the globalization era, Euro region has just stood at

the side line and watched the other two major economic blocks of the world,

USA and Asia Pacific region led by Japan, danced into the death spiral

of tremendous trade imbalance; the trade imbalance is first induced by

wanton spending policy of Reagan era and then intensified by the persistent

currency market manipulation of Japan, under the nod of US government,

in Clinton era(Ref. 1).

During that period the major trend of the core currency of euro region,

German Mark, can be summarised in one sentence, "follow Japanese Yen".

However, near the end of the 20 th century, German Mark and then Euro has

started to diverge from Yen, and has attained its own life vs. Dollar.

The substantially weak Euro in the stretch of 1998 to 2000 has pushed US

trade deficit with Europe to about 1 % of US GDP and ranked US trade deficit

with Europe the second largest trade deficit of US with a specific region

just after China. It becomes necessary to study the behavior of Euro/Dollar

rate and the trade pattern between US and Europe independently in order

to fully understand the current Dollar and trade deficit crisis of USA.

In Section 2, it will be shown

that the trade balance between US and Europe is determined by Euro/Dollar

exchange rate with the rate enjoying at least one and one-half years

of leading time, that is, the trade balance with Europe at the end of 2003

is determined by the Euro/Dollar exchange rate at the summer of 2002 or

earlier. In Section 3 not only the major trend of Euro/Dollar rate, but

the noticeable secondary fluctuations of the exchange rate since 1980 are

explained from economic, financial, and political factors. The last section

is for discussions where Euro/Dollar rate and US-Europe trade balance are

going.

2. Euro/Dollar Rate Determines US-Europe Trade Balance

It is first shown that the trade

balance between US and W. Europe(Ref. 2) is determined by the exchange

rate of Euro/Dollar(Ref. 3).  Euro is introduced at the beginning of year 2000. Before that time, German Mark, the core currency of Euro region,

is multiplied by a factor 1.95583 and is considered as the surrogate of Euro. The pattern of trade balance of US with more narrowly defined Euro

region has turned out to be almost exactly the same as that of W. Europe, so the trade balance with W. Europe is used here.

In Fig. 1, the exchange rate of Euro/Dollar is plotted in quarterly interval as the black curve,

and the ratio between the trade balance with W. Europe and the nominal GDP of USA, expressed in percentage, is also plotted in quarterly

interval as the red curve.

Euro is introduced at the beginning of year 2000. Before that time, German Mark, the core currency of Euro region,

is multiplied by a factor 1.95583 and is considered as the surrogate of Euro. The pattern of trade balance of US with more narrowly defined Euro

region has turned out to be almost exactly the same as that of W. Europe, so the trade balance with W. Europe is used here.

In Fig. 1, the exchange rate of Euro/Dollar is plotted in quarterly interval as the black curve,

and the ratio between the trade balance with W. Europe and the nominal GDP of USA, expressed in percentage, is also plotted in quarterly

interval as the red curve.

The time scale of the exchange rate curve is shifted toward right by

one and one-half years compared to the time scale of the red trade balance

curve. The major trend of the exchange rate curve indicated by the peaks

and valleys, A, B, and C coincides reasonably well with the peaks and valleys

of the red curve. This implies that the exchange rate leads the actual

trade balance by about one and one-half years to two years, that is, US

- W. Europe trade balance in the first half of 2004 is determined roughly

by the exchange rate of Euro/Dollar at the first half of 2003.

3. Reasons Behind the Gyrations of Euro/Dollar Rate

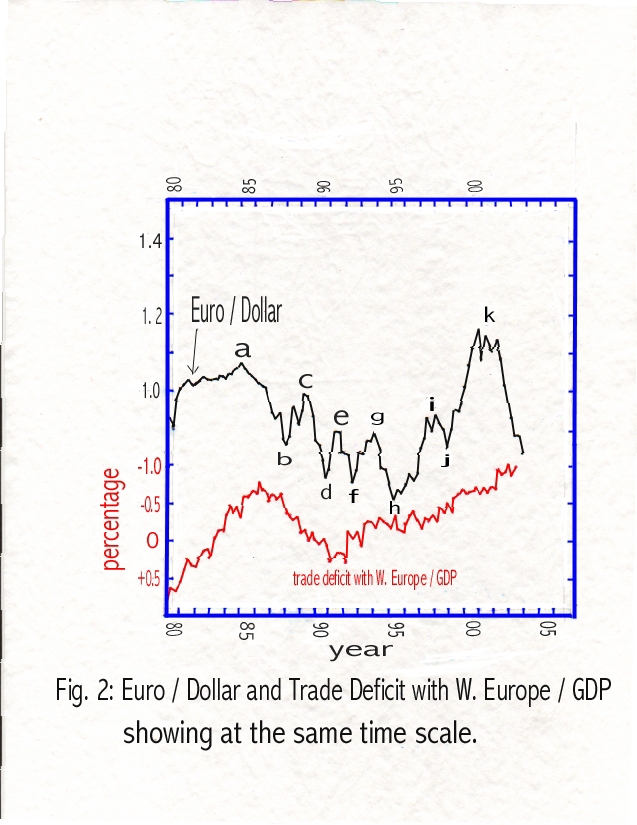

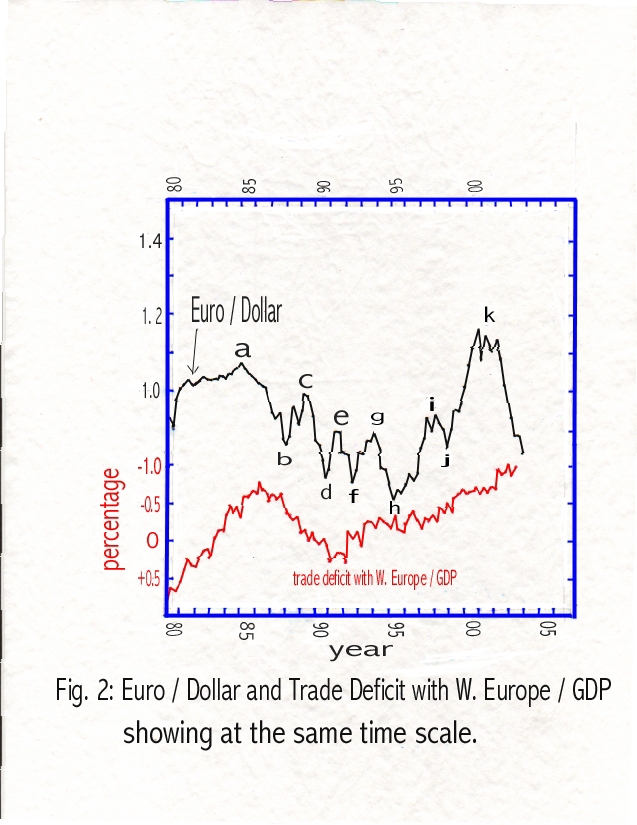

In the previous section we have

shown that US - W. Europe trade balance is determined by Euro/Dollar exchange

rate. The next question is what determines the exchange rate? When the

major trend of trade balance changes, it in turn will influence the exchange

rate. However, there are also many other financial, economic, and political

factors which also will influence the exchange rate. To study not only

the major trend but all the visible secondary ups and downs of the exchange

rate, two curves in Fig. 1 are replotted in Fig. 2, but this time the time

scale of Euro/Dollar rate is synchronized to that of the trade balance

curve. Major peaks and valleys on the curve of Euro/Dollar rate which we

will discuss are marked from "a" to "k" in Fig. 2.

The exchange rate curve,

the black one in Fig. 2, raises from the leftmost point to point "a", indicating

the weakening of German Mark against US Dollar from 1980 to 1985. This

weakening of German Mark is due to the persistently high real interest

rate in USA than that of Europe during that period. The high real interest

rate of USA was the consquence of huge Federal Government budget deficit

and the policy to finance the deficit with the issuance of treasury debt

instruments, instead of just printing money as done in Carter administration

that fueled high inflation of late 1970's. The persistent weakening of

German Mark and Japanese Yen under the influence of high real interest

rate of USA had made US trade deficit explode; by 1985 US trade deficit

with W. Europe approached 0.5% of US GDP and US trade deficit with Japan

reached 1% of US GDP. The exploding trade deficit imposed heavy financial

burden on US heavy industries which competes with the counter parts of

Europe and Japan. With general election looming in 1986 and under strong

pressure from domestic heavy industry to do something about this first

phase of run away trade deficit, Reagan adminstration in 1985 consulted

with leading industrial nations and decided to sharply upward revaluate

Japanese Yen; this decision was carried out by verbal and coordinated currency

market internventions, causing Japanese Yen to move from near 250 Yen/Dollar

to around 125 Yen/Dollar by the latter half of 1987. West Germany and Japan

have been two economic miracles during the recovery phase after the World

War II, and German marks and Japanese Yen were always grouped together

and pitched against US Dollar as the barometer of the currency market.

Thus the sharp upward revaluation of Yen from 1985 to 1987 also prompted

strong upward revaluation of German Mark throughout the time period, as

can be seen on the exchange rate curve of Fig.2 from point "a" to point

"b".

The sharp upward revaluations of

Japanese Yen and German Mark against US Dollar, started in 1985 finally

curbed the exploding US trade deficit. From the red curve of Fig. 2 we

can see the US trade deficit against W. Europe peaked in 1986 and dropped

sharply near the end of 1987, and US economy entered the phase of slower

and slower growth. Sensing this sea change in economic condition, US stock

market crashed in October of 1987 (see Ref. 1 for detailed discussions

of US economic booms and busts). The currency market hailed the demise

of US trade deficit and immediately started to weaken both Yen and Mark,

thus the uptrend of the exchange rate curve marked from "b" to "c". In

1989, Soviet Union started to crumble, and that was a trenmendous boost

for Western Europe in general, and Germany in particular, so German Mark

staged a quick strengthening as shown on the black curve of Fig. 2 from

"c" to "d". However, in 1991 first West Germany overpaid East Germany in

the monetary reunion, causing the cave in of East German industries and

huge unemployment in the east, and then Russia, following bad economic

advises, sank into economic chaos. Realizing that the collapse of the communist

block may cause substantial uncertainty in Europe, German Mark started

to weaken again as the section from "d" to "e" testifies.

The fluctuations from "c" to "e"

in the exchange rate curve of Fig. 2 is due to special factors of Europe,

and is absent in the exchange rate curve of Yen/Dollar (see Fig. 3 of Ref.

1). Yen rather continued to strengthen against Dollar until 1995. During

that period, US corporations restructured extensively to export manufacturing

jobs to Asian countries like Taiwan whose currencies are fixed against

Dollar. Thus despite steadily strengthening Yen, US trade deficit started

to expand from 1992. Eventually German Mark had no choice but to reflect

the strengthening Yen and expanding US trade deficit and started to strengthen

too, as displayed by the section of the exchange rate curve of Fig. 2 from

"e" to "f". Then as the first Gulf War concluded successfully, US Dollar

enjoyed a brief period of strength (from "f" to "g") against German Mark,

but eventually steadily increasing US trade deficit pulled German Mark

up along the continuingly strengthening Yen as indicated by the section

of "g" to "h".

In 1995 Japan made a drastic change

in its monetary and Yen-Dollar policy. It pushed Japanese interest rate

toward zero and started massive currency market manipulation to artificially

destroy the value of Yen against Dollar. With many industrial products

still competing with Japan, German Mark could only tag to Yen and became

weaker against Dollar as well, as depicted in the section from "h" to "i";

the artificial weakening of Yen from 1995 to 1998 was done with the encouragement

of Clinton administration under the name of "strong Dollar policy". This

currency market manipulation of Japan induced the 1997 Asian economic crisis,

has pushed Japan into the chronical recession from which it has not recovered

even today, and the ripple effect finally reached Mexico and Russia by

1998. Japan and US were forced to reverse the artificial weak Yen- strong

Dollar policy and made coordinated internvention to weaken Dollar, causing

the sharp drop of Dollar vs. Yen. This sharp drop of Dollar is also reflected

on German Mark as can be seen in the section "i" to "j" of the exchange

rate curve of Fig. 2. The detailed description of the disastrous effect

of Japan's currency manipulation can be found in Ref. 4, and how the drop

of Dollar in 1998 caused the shrinkage of US trade deficit, the burst of

dotcom bubble and ushered in an economic recession in the time span of

2000 to 2001 is explained in Ref. 1.

From 1998, another unique European

factor has set in, that is, the scheduled inaugulation of Euro. Euro is

an artificially created currency by combining strong German Mark with several

weak European currencies. Thus it is equivalent to the transfer of wealth

from Germany to other countries. The natural result of such a combination

is for the strong currency to fall, as shown in the portion from "j" to

"k"; after the inaugulation of Euro at the beginning of 2000, the uncertainty

of the new Euro market prompted Euro to continue to fall against Dollar.

However, steadily weakening Euro has pushed US trade deficit with Europe

to very high level. The natural mechanism of a free curreny market then

demands Euro to strengthen in order to reduce the run away US - Europe

trade imbalance. Thus at point "k", Euro has started to bottom out and

eventually turned to sharply stronger as US trade deficit with Europe approached

1% of US GDP. In recent months the trend of the strengthening Euro is further

accelerated by the failure of Euro Central Bank to match very low interest

rate in US.

4. Conclusions and Projections

With sharply stronger Euro from

2002 and on, it is a matter of time that US trade deficit with Europe will

shrink and then Euro will weaken against Dollar. This turn around will

occure at latest by the second half of 2004. If Euro Central Bank lowers

interest rate before that time, then the turning point will come sooner.

It is always difficult to estimate

how strong Euro will be at its peak. One way is to use some technical analysis

and view the strongest point, "h", on the exchange rate curve of Fig. 2

as the land mark. That point corresponds to 0.72 Euro/Dollar, or 1.39 Dollar/Euro

based on quarterly average. Thus translated into daily trading, Dollar/Euro

may be higher than 1.39 at the peak. If European interest rate is lowered,

not only the peak of Euro will come sooner, but its peak value will also

be lower than the land mark value discussed here.

Though there is no explicit central

bank internvention in Euro, it still can not escape the currency manipulation

effect of Yen/Dollar. However, compared to Japanese Yen, Euro is already

substantially free from artificial manipulation. Thus to some limited degree

the free Euro/Dollar market is allowed to selfcorrecting the imbalances

of trades between USA and Europe. The Euro Central Bank should learn

the serious mistake of Japanese Government of manipulating the currency

market and refrain from direct internvention of the currency market to

weaken Euro. If it feels that Euro has risen enough, then it can always

lower European interest rate. Actually Euro Central Bank is too concerned

about the phantom of inflation. With the rise of Euro in recent months,

Euro region's trade balance will soon shift toward deficit, imports will

flood European market, and it will be "disinflation", not "inflation" that

will be the norm for Europe in coming years, just as USA has expeienced

during the years of trade deficit explosions; this will leave plenty of

room for Euro Central Bank to lower European interest rates.

References

1. Yen/Dollar, Trade Deficits, and

Recent Boom Bust Cycles of USA by Chih Kwan Chen (Aug. 2003).

2. From data compiled by Bureau of

Economic Analysis .

3. From quarterly data compiled by United

States of America Federal Reserve System.

4. The Super Low Interest Rates

of Japan, and The Anomalies of World Economy, by Chih Kwan Chen (Dec.,

1998).

Euro is introduced at the beginning of year 2000. Before that time, German Mark, the core currency of Euro region,

is multiplied by a factor 1.95583 and is considered as the surrogate of Euro. The pattern of trade balance of US with more narrowly defined Euro

region has turned out to be almost exactly the same as that of W. Europe, so the trade balance with W. Europe is used here.

In Fig. 1, the exchange rate of Euro/Dollar is plotted in quarterly interval as the black curve,

and the ratio between the trade balance with W. Europe and the nominal GDP of USA, expressed in percentage, is also plotted in quarterly

interval as the red curve.

Euro is introduced at the beginning of year 2000. Before that time, German Mark, the core currency of Euro region,

is multiplied by a factor 1.95583 and is considered as the surrogate of Euro. The pattern of trade balance of US with more narrowly defined Euro

region has turned out to be almost exactly the same as that of W. Europe, so the trade balance with W. Europe is used here.

In Fig. 1, the exchange rate of Euro/Dollar is plotted in quarterly interval as the black curve,

and the ratio between the trade balance with W. Europe and the nominal GDP of USA, expressed in percentage, is also plotted in quarterly

interval as the red curve.